Insurance Compliance Without the Paper Chase

Claims evidence scattered across emails, drives, and inboxes costs you time, delays settlements, and puts FCA compliance at risk. SmartAssessor centralizes everything in one audit-ready platform.

The Real Cost of Scattered Evidence

Your Challenge

What It's Costing You

How SmartAssessor Fixes It

Claim evidence spread across emails and shared drives

Delays, rework, and frustrated policyholders

One secure hub for all uploads with timeline tagging

Siloed communications between adjusters and teams

Gaps in audit trails and regulator scrutiny

Centralized file linked to each claim with full user log

Manual preparation for FCA and compliance audits

Days lost compiling evidence under pressure

Auto-export FCA and ISO-ready digital evidence bundles

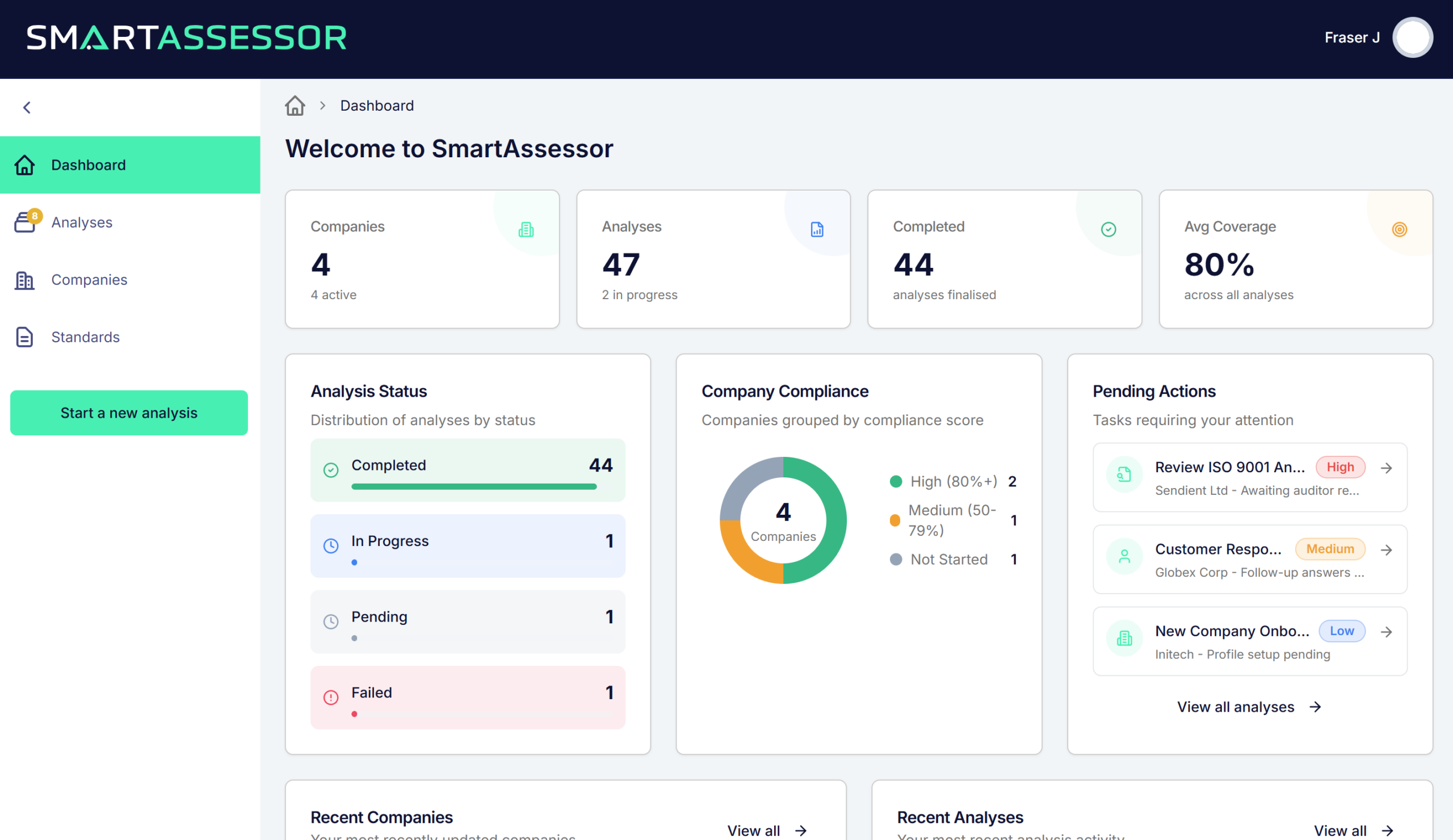

Limited oversight of claims and compliance status

Errors, inconsistencies, and the risk of fraud

Real-time dashboards show what's missing or overdue

Built for Insurance Teams

TRUSTED IN REGULATED ENVIRONMENTS

"SmartAssessor has fundamentally changed how we manage compliance evidence. We’ve moved from reactive audits to continuous readiness."

Head of Safety, UK Construction Group

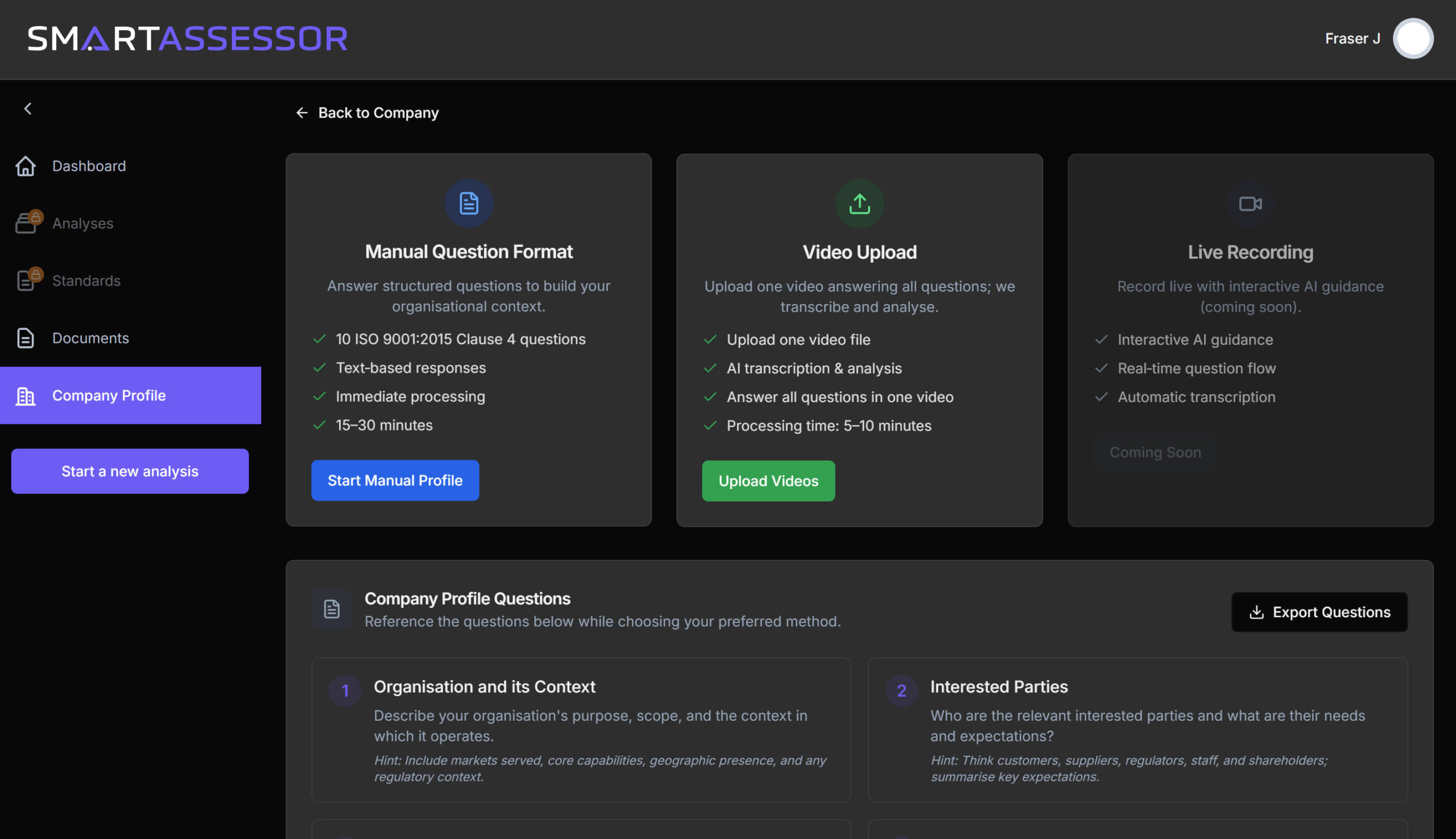

Audit Ready In Three Steps

Step 1: Upload Your Evidence

Add claim photos, adjuster reports, call logs, emails, and signed forms. Upload from any device, tag to the relevant claim or policy.

Step 2: Map to Regulations & Claims

SmartAssessor links evidence to FCA rules, ISO clauses, or internal compliance requirements. Everything stays organised and traceable.

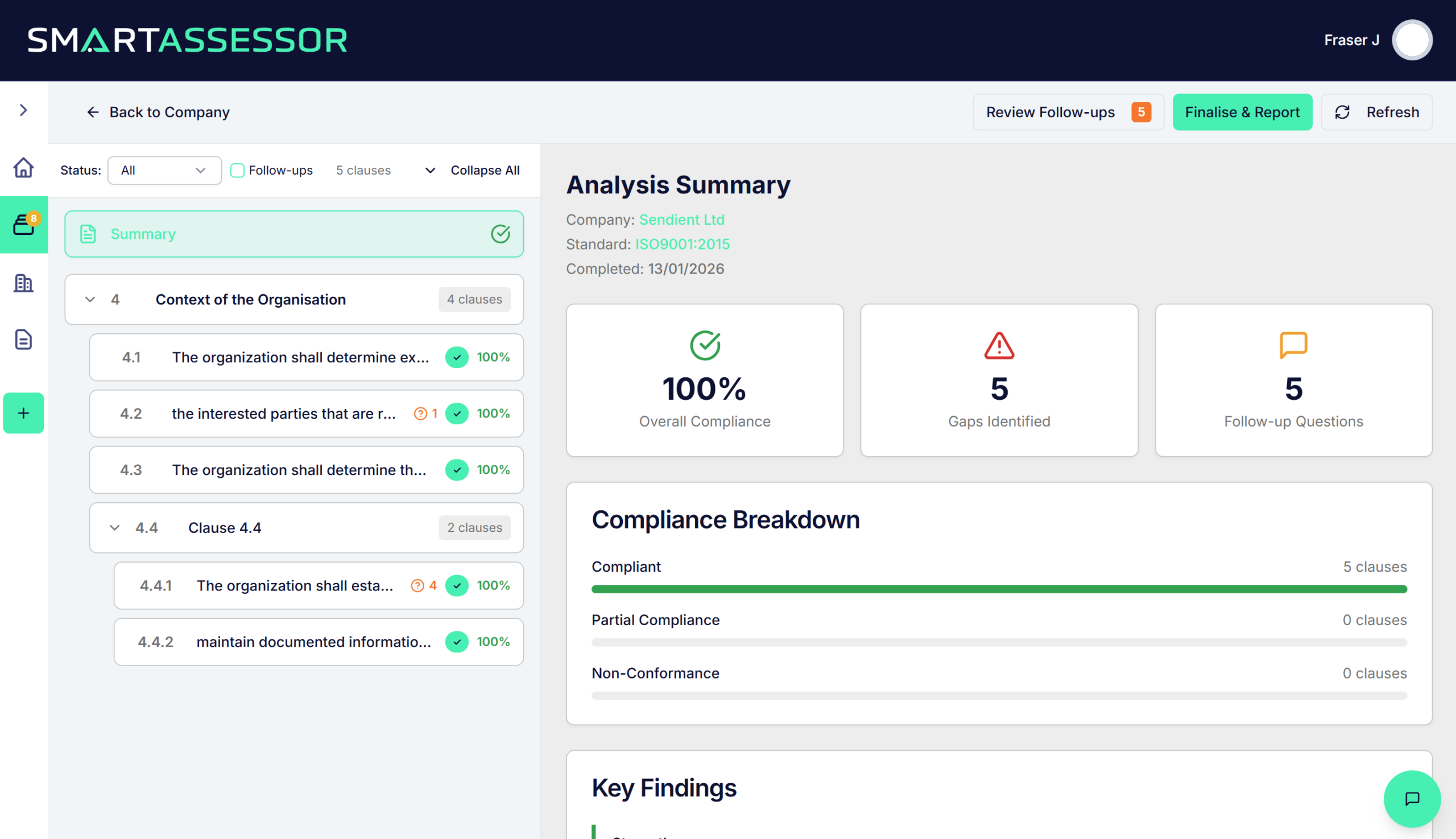

Step 3: Track and Report

See compliance status across claims in real-time. Export audit-ready bundles for FCA reviews, reinsurers, or ISO assessors.

Ready to Simplify Your ISO Audits?

See how SmartAssessor helps compliance teams stay audit-ready year-round.