Insurance Compliance Without the Paper Chase

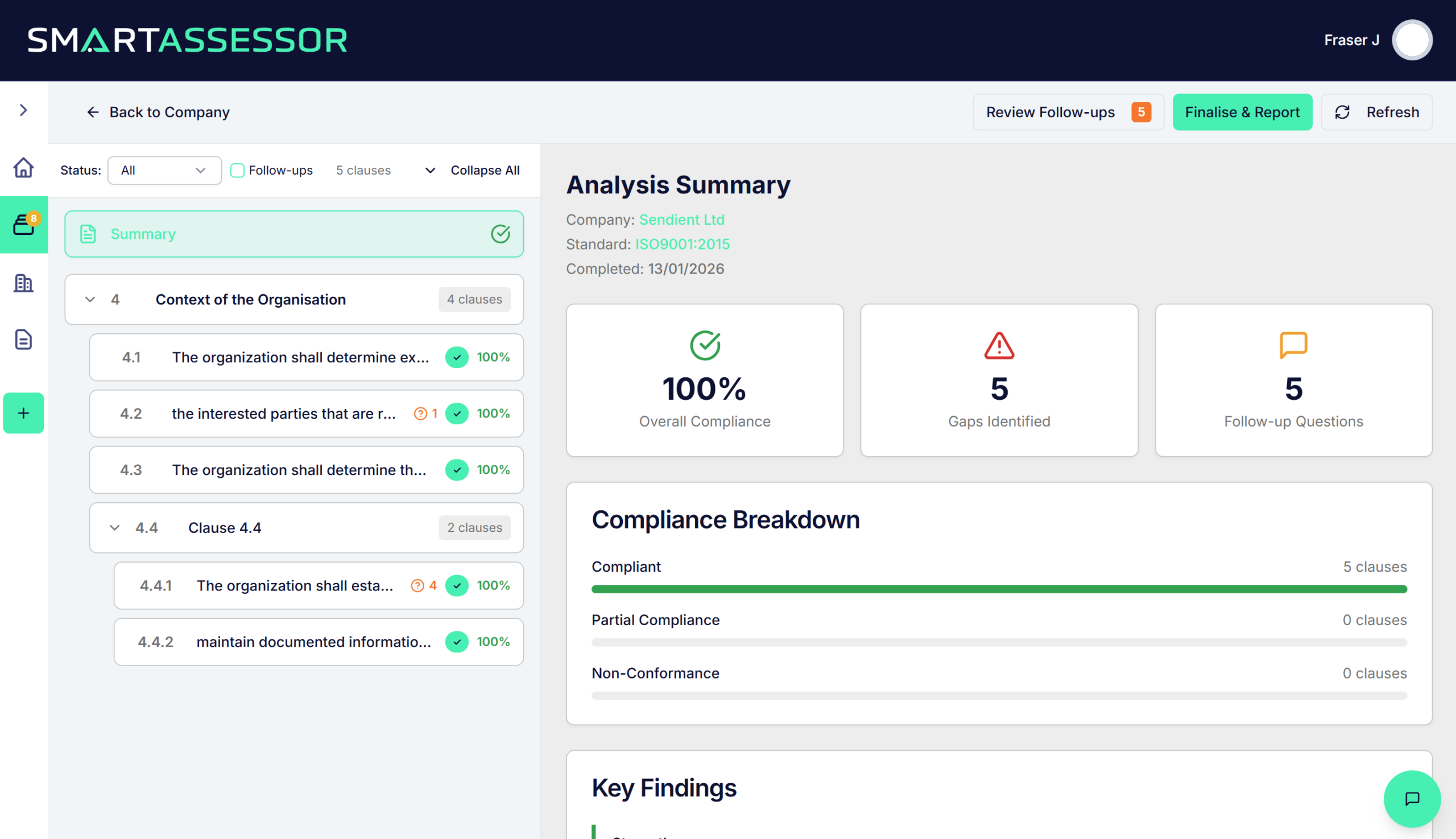

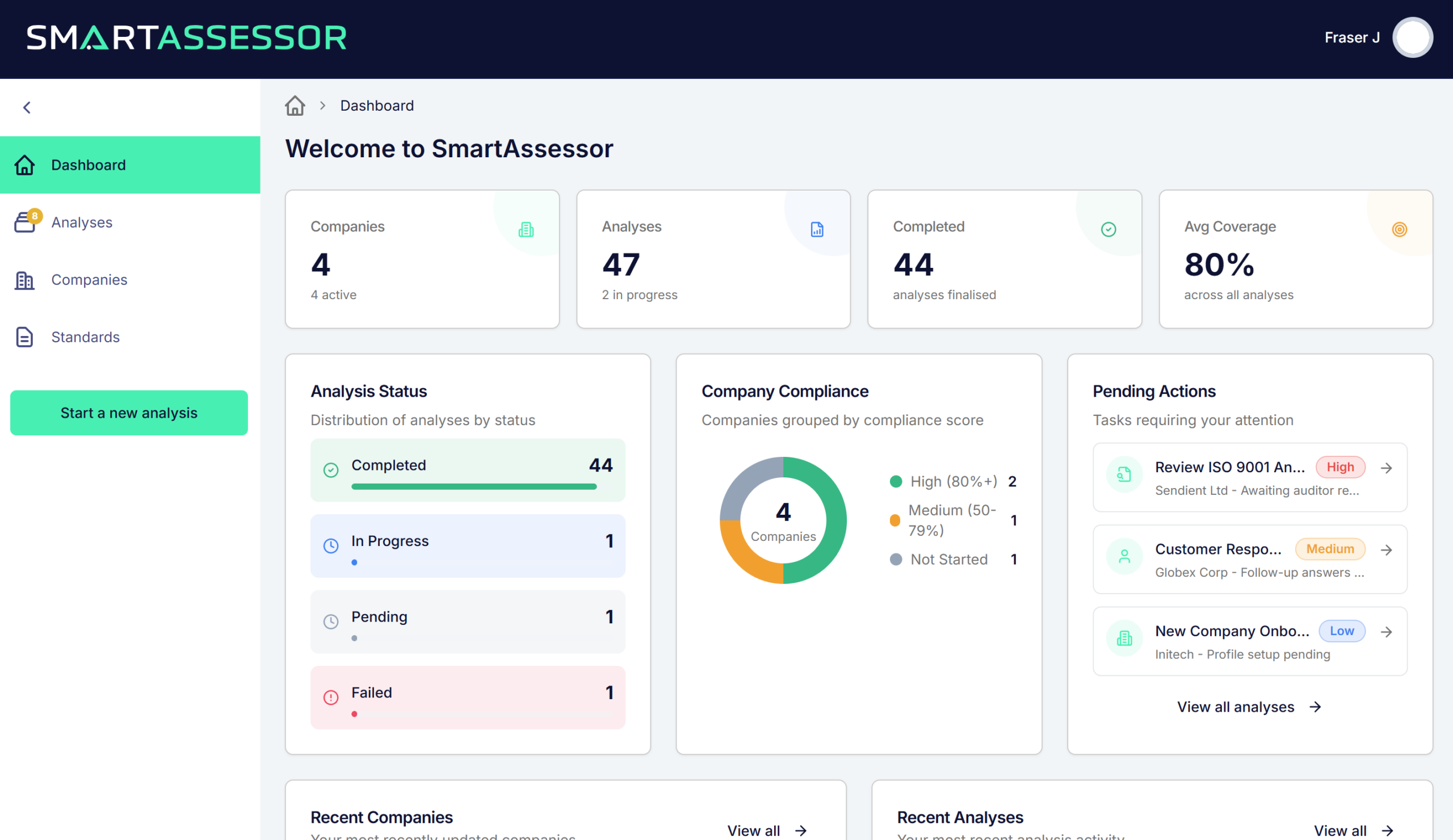

Complex organisational assessment delivered using the power of AI. Instantly assess an organisations readiness for your insurance product, resulting in real-time scoring and flagging of critical issues/exposures

The Real Cost of Scattered Evidence

Assessing an organisation’s readiness for your insurance product can be straightforward, but in complex insurance scenarios this is not the case. Whether it is a new application or a renewal, accurately assessing an organisation and their insurance risk exposure based on numerous variables is vital. The SmartAssessor platform is able to provide an instant, evidence-based risk score, integrating seamlessly with your existing systems, allowing real-time quotation or expert review. Renewals are rapidly assessed with key changes located, analysed, flagged and scored, allowing your expert advisors to quickly focus-in on the key risks.

Built for Insurance Teams

TRUSTED IN REGULATED ENVIRONMENTS

Move from reactive audits to continuous compliance. SmartAssessor keeps your evidence organised, accessible, and inspection-ready at all times.

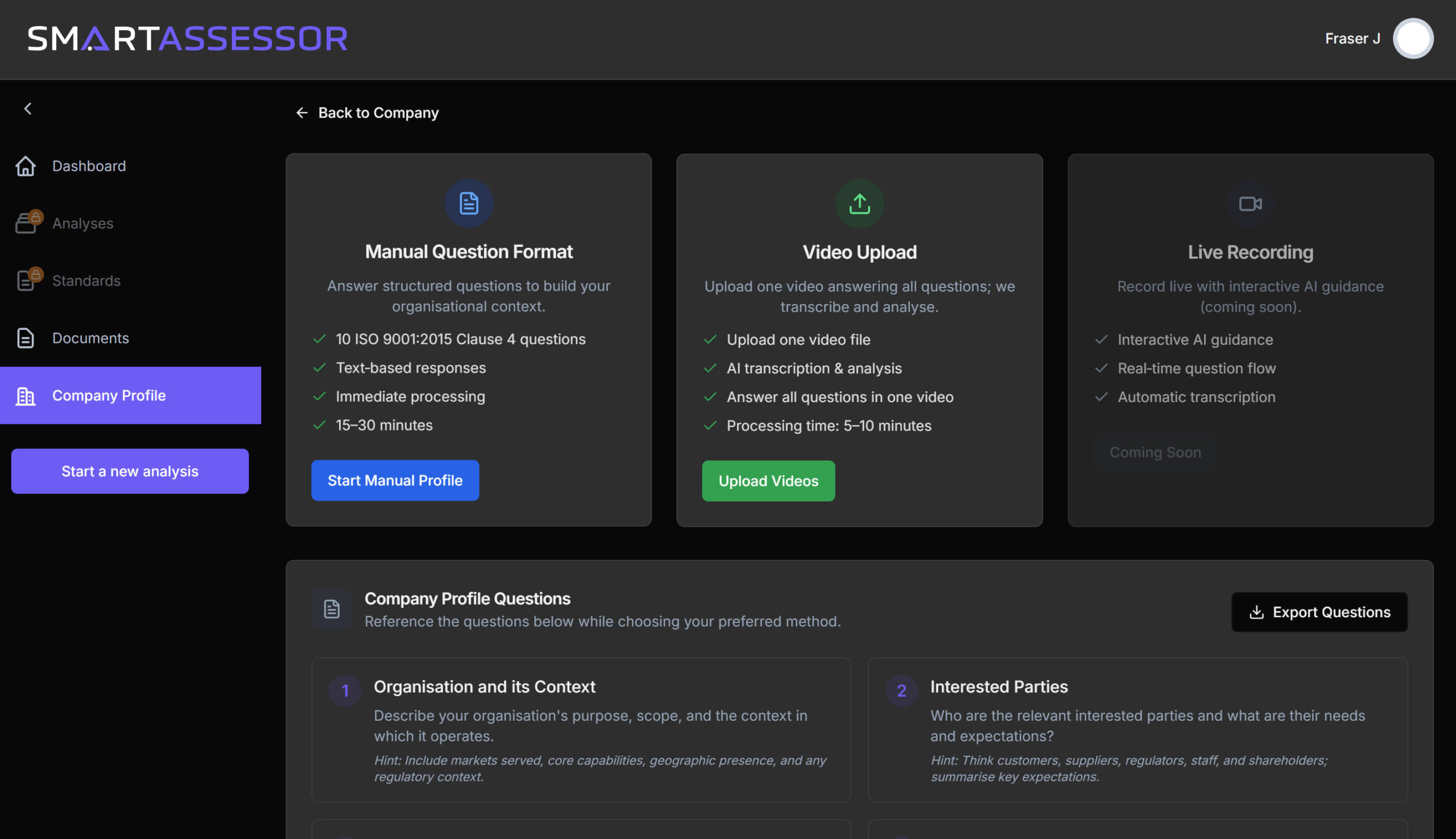

Audit Ready In Three Steps

Step 1: Upload Your Evidence

Add claim photos, adjuster reports, call logs, emails, and signed forms. Upload from any device, tag to the relevant claim or policy.

Step 2: Map to Regulations & Claims

SmartAssessor links evidence to FCA rules, ISO clauses, or internal compliance requirements. Everything stays organised and traceable.

Step 3: Track and Report

See compliance status across claims in real-time. Export audit-ready bundles for FCA reviews, reinsurers, or ISO assessors.

Ready to Simplify Your ISO Audits?

See how SmartAssessor helps compliance teams stay audit-ready year-round.